Early Stages

Choosing a business structure: A questionnaire

How to name your co-op: a by-province guide

How to start a co-operative: a step-by-step guide

Creating an action plan

What is a steering committee, and what does it do?

Transitioning a Business to a Co-operative

Co-operative Members and Governance

Choosing a Co-op Type

Hosting a Community Meeting

Focusing Ideas for Your Co-operative

Co-operative Business Model Comparison with Other Models

Building Consensus

Business Planning

Risk Identification and Management

Legal Risks for Co-op Start Ups

Do a PESTLE Analysis

How to find new co-op members

How to create a governance structure

Creating a Preliminary Budget — A Guide

Building a Business Model Canvas

Why create a business plan? (video)

Roles and Responsibilities

Business Planning Pitch Practice

How to allocate your co-op’s profits

Co-operative Members and Governance

Up and Running

For Boards of Directors

Annual General Meeting Preparation

Three AGM Resolutions Every Co-op Needs for their Annual General Meeting

What you need to know for your first AGM

Annual Meeting Checklist

How to Waive an Audit

Sample Board Duties

How to Build a Board Calendar

How to write a Board of Directors’ Code of Conduct

Write a compliance checklist

How to issue dividends

Sample Co-op Equity Statement

Creating a Terms of Reference

Creating a Strategic Plan

Creating a Human Resources Policy

Free Online Governance Course

Creating a Conflict of Interest Policy

Board of Directors Evaluations

Board Member Recruitment

Board Decision-Making Exercise

Being a Board Member in a Co-operative Business

How to allocate your co-op’s profits

Templates for Boards

Sample Co-op Equity Statement

A Guide to Meeting Minutes

Providing Notice for Annual General Meeting

Annotated Agenda for an AGM

How to write a Board of Directors’ Code of Conduct

Write a compliance checklist

Sample Terms of Reference

Sample Resolution

Sample Membership Agreement

Sample Financial Policy

Sample Manager Job Description

Board Governance Tips for Indigenous Co-operatives

Sample Bookkeeper Contract

How to write a Board of Directors’ Code of Conduct

Write a compliance checklist

How to issue dividends

Sample Co-op Equity Statement

A Guide to Co-operative Insurance

How to Read Financial Statements

Keeping track of members in a co-op

Everything you need to know about managing records

Member Engagement and Onboarding

Guidelines for co-operative elections

Filing your Annual Return

Co-operative Annual General Meetings

Ongoing Capitalization

How to allocate your co-op’s profits

Additional Resources

Supports for Co-operative Development

World Trade Centre Winnipeg

Gabriel Dumont Institute (SK)

Clarence Campeau Development Fund

Saskatchewan Indian Equity Fund

BC Chamber of Commerce

Alberta Chamber of Commerce

Saskatchewan Chamber of Commerce

Manitoba Chamber of Commerce

Start Up Canada

Futurpreneur

SK Start Up Institute

Business Link (Alberta)

Government of Canada Information Guide on Co-operatives

Guide to starting a renewable energy co-op

Big Co-operatives

Western Economic Diversification

Provincial Co-operative Associations

Provincial Business Development Centres

Community Futures Network

Co-operatives First

Additional Links

Business Benefits Finder

BDC’s financial planning tool

BDC’s entrepreneur toolkit

Guide to building an Opportunity Development Co-operative

Futurpreneur’s general tools, tips, and resources for entrepreneurs

Futurpreneur Canada Cash Flow Template

Co-ops and charitable status

Back

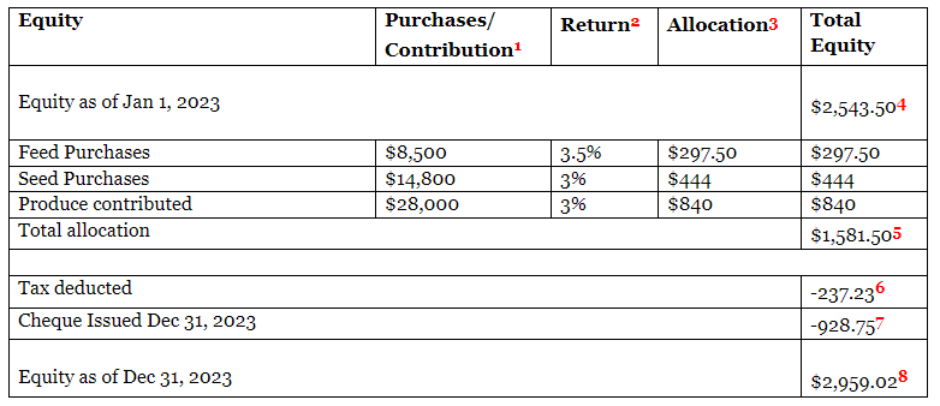

Sample Co-op Equity Statement

If your co-op shares its profits with your members, you should also provide members with an equity statement. An equity statement will set out a member’s share of annual profits, the portion being retained by the co-op, the cash they’ll receive, and the equity they build up over time.

If your co-op has multiple lines of business or different ways for the members to use the co-op, you should identify those on the statement.

- The purchases/contributions are the business the member has done with the co-op. In this example, the members both purchase supplies from the co-op and contribute produce to the co-op.

- A member’s return is determined annually by the board to calculate patronage dividends. A return is usually calculated as a percentage of business done with the co-op during the co-op’s fiscal year.

- A member’s allocation is the value of their share of the co-op’s profit that they’ve been allocated.

- This is the member’s equity/interest in the co-op as of the beginning of the fiscal year. This amount reflects their initial investment as a member and the portion of their allocations that have been retained by the co-op in past years.

- A member’s total allocation is the total value of their share of the co-op’s profits.

- A co-op will normally withhold a portion of a member’s allocation for taxes.

- Co-ops will normally issue a cheque to members for part of their allocation. Other co-ops, like worker co-ops, may be set up with direct deposit and can deposit member allocations into their chequing accounts. The board will determine the proportion of a member’s allocation the co-op will issue to them via cheque, and the proportion the co-op has retained in the member’s name.

- This is the member’s equity/interest in the co-op at the end of the fiscal year. In this example, the co-op retained a portion of the member’s allocation in the member’s name, increasing the member’s total equity.