How to Read Financial Statements

How to Read Financial Statements

This resource provides a guide on how to read financial statements. Use it as a guide to understanding your co-op’s financial position.

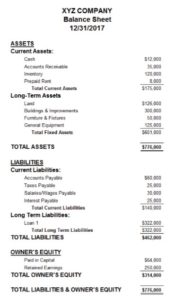

The Balance Sheet

A balance sheet demonstrates the business’ worth at any one point in time. At its core is a simple equation: Assets = Liabilities + Equity. Let’s look at what each of these terms mean.

Sample Balance Sheet

Source: Basic Accounting Help

Assets

Assets are what the business uses to operate and demonstrate value. Typically assets are divided into the following categories:

- Current assets: Goods that can be easily ‘converted into cash’ (i.e. sold). These include things like inventory (goods that have not been sold), cash the co-op has on hand, accounts receivable (money that is owed to the co-op), and (if applicable) raw materials (goods that need to be used to make inventory/products).

- Investments: Money the co-op has invested in other companies.

- Non-current (long-term) assets: Assets that are not easily turned into cash. These include property the co-op owns (buildings and equipment) and intangible assets. Intangible assets include things like intellectual property (patents or copyrights) and goodwill (the value of the co-op’s brand, reputation, customer relations).

Liabilities

Liabilities are amounts owed by the co-op. Liabilities are usually divided into the following groups:

- Current liabilities: Obligations paid within one year. These often include short-term loans, accounts payable (amounts the co-op owes to suppliers), and current portion of long-term debt (the interest payments a co-op will pay that year).

- Long-term liabilities: Obligations paid over more than a year. This generally includes loans or mortgages paid over several years.

Equity

Equity is the amount of money invested into the co-op by its owners. Equity includes any money members pay when they join the co-op, amounts invested by members when the co-op incorporated, and any money the co-op retained in past years. It’s important to remember that equity is not treated the same as cash because it must eventually be paid back.

As mentioned, assets should always equal liabilities plus equity. Using the balance sheet categories of assets, liabilities, and equity, you can rearrange the numbers and use some simple math to test for financial vulnerabilities. To better understand why this matters, it’s helpful to assess a balance sheet using the following 3 lenses: New Worth, Debt-to-Equity, and Working Capital.

- Net worth: Net worth is equal to a business’ equity (Equity = Assets – Liabilities). Net worth highlights how much cash a co-op would have left if it liquidated its assets and paid off any debts. The higher this number is, the better.

- Debt-to-equity ratio: Liabilities/Equity=Debt-to-Equity. This ratio demonstrates how a company is financing its operations (mostly debt or mostly equity). A company with low debt-to-equity ratio is generally seen as less risky. A high debt-to-equity ratio means the co-op’s equity would not cover the cost of its debt, which makes it riskier. For a quick refresher on the difference between debt and equity, check out this video.

- Working capital: Current Assets – Current Liabilities = Working Capital. Working capital demonstrates a co-op’s liquidity (liquidity = how quickly it can access cash). Higher working capital means the co-op can quickly make investments. Low or negative working capital means the co-op is at risk of defaulting on its debts.

NOTE: a balance sheet only tests a business at one point in time. Because a business is dynamic, and its financial position changes quickly over time, a balance sheet should be checked regularly. It should also be used alongside other financial tools, such as income sand cash flow statements, to provide context for why the balance sheet reads the way it does.

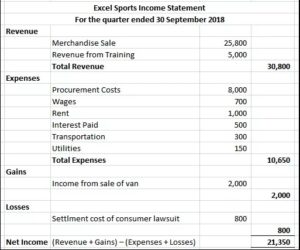

Income Statement

An income statement (sometimes called statement of net savings or profit and loss statement) provides a snapshot of how a business performed in a certain period, usually over one month or a fiscal year. What the income statement looks like depends on the industry the co-op operates in. (An income statement for a consulting firm will look quite different than one for a grocery store, for example.) But the same principles apply and the equation is the same.

Sample Income Statement

Source: Investopedia

To quickly calculate a co-op’s net income, use the following equation:

Net income = (revenue + gains) – (expenses + losses)

Let’s take a look at what each of these terms mean.

Revenue refers to the money the co-op gets from selling goods and services (e.g. auto parts, consulting services, rental income, royalties, ad space, etc.). Some co-ops subtract the cost of goods sold from total sales to give a figure called the gross margin. Retail co-ops often adhere to this practice because understanding gross margin provides a more accurate representation of its operating revenue.

Gains are other sources of income that come from one-time transactions outside the co-op’s ordinary operations. This could include selling some of the co-op’s old equipment or unused land.

Expenses refer to the costs a co-op pays to operate. This includes the cost of goods sold (if not already included in the gross margin calculation), labour costs, administration, interest paid on loans, loan payments (amortization), bills, and depreciation. It’s helpful to check various expenses against an industry standard to determine if your co-op is spending too much.

Losses refer to one-time, often unusual costs. This might include a settlement paid as part of a lawsuit or a fine for violating regulations.

Net savings, or profit, is the revenue the co-op has left after all its expenses are paid. This is a good indicator of the financial performance of the co-op, but several different things can impact it. Natural disasters, a new competitor, or a labour dispute can affect a co-op’s profit. Because co-ops exist to provide services to their members, members and/or management may not think they need to generate as much profit as the co-op’s competitors. This can be a slippery slope. Co-ops need profits to re-invest in their operations, expand, and give back to their members and community. A co-op that loses money each year runs the risk of being unsustainable in the long term.

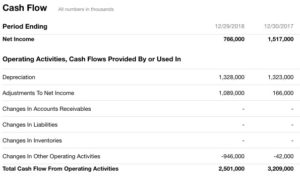

Cash Flow

A cash flow statement reflects all the transactions of a co-op in a given period, and learning about it is necessary part of reading financial statements. Usually this statement covers a month or one fiscal year.

The statement shows where a co-op’s cash is coming from, if it’s taking on large sums of debt, if its investments are performing well, and if its operations are resulting in positive cash flow.

Normally divided into three sections, a cash flow statement covers: operational activities, investment activities, and financing activities. The total sum of all these activities give the co-op’s total cash or net cash flow.

A co-op that doesn’t generate positive cash flow from operations may need to rely on financing or investment activity to keep operating or expand.

Loblaws Cash Flow from Operating Activities

Source: Yahoo Finance, Loblaw Companies Limited (L.TO)

Let’s clarify a few terms we used.

Operating activities: A co-op’s operating activities refers to its ordinary business and the revenue or costs required to maintain operations.

Investing Activities: A co-op’s investing activities refer to the investments the co-op makes. This includes investments the co-op holds in other organizations (e.g. banks, stocks, bonds) as well as investments it makes in itself (e.g. buying or selling equipment, land, or other property.

Cash flows from ‘investing activities’ include any cash transactions related to the co-op’s investments and capital. Important items under this section include capital expenditures (i.e. money spent on the business’ property), like selling old equipment (positive cash flow, because money is coming in) or investing in a new building/equipment (negative cash flow, because money is going out).

A negative cash flow from investing activities usually means the co-op is re-investing in its business. This isn’t a bad thing — companies that have high capital expenditures tend to grow. Any dividends the co-op gets from its investments would be recorded under this section as positive cash flow. In the Loblaws example below, you can see that the company is investing in capital expenditures and has seen a return on its investments.

Loblaws Cash Flow from Investing Activities

Source: Yahoo Finance, Loblaw Companies Limited (L.TO)

Financing Activities: A co-op’s financing activity refers to its borrowing activity (e.g. repaying debt and taking on new debt) and member investments (e.g. selling shares/memberships to members and issuing dividends).

Cash flow from financing activity demonstrates how the co-op handles its debt and equity. In this section, positive cash flow usually indicates money coming into the organization from debt or equity financing (e.g. new memberships or new loans) while negative cash flows are often good things like debt repayment and issuing dividends. In the Loblaws example below, the company took on new debt (borrowings), but also issued returns to members (dividends paid).

Loblaws Cash Flow from Financing Activities

Source: Yahoo Finance, Loblaw Companies Limited (L.TO)

The healthiest co-ops have statements that show lots of cash flow into the business from operational activities, and cash flow out through investing and financing activities. This means the co-op is using its operational activities to pay down debt, invest in operations, and return money to its members. When reading a co-op’s cash flow statement, consider what kind of activities it’s doing. A major expansion might distort the co-op’s cash flow, but could have long-term benefits. Comparing cash flow statements from different years offers a better sense of what the co-op is doing and how well it manages cash.

In the Loblaws example, the business sees a lot of cash flow from its operations and issues dividends to investors. It’s also investing in its business through capital expenditures, which likely requires taking on new debt. But this debt could lead to increased revenue and provide longer term stability.

Stay Informed

The tips mentioned here provide a basic understanding of how to read financial statements and outline a few warning signs to watch for. But don’t be afraid to ask questions of your board or management. If you don’t understand something in a statement, ask. At the end of the day, members are tasked with holding the board accountable and the board must hold management accountable. Asking tough questions is a great way to ensure accountability. So, stay informed and ask questions.

Enjoy this tool on how to read financial statements? Then you’ll like our tool on creating a preliminary budget.

Was this useful?4 people found this useful.