Budgeting and Co-operatives

Budgeting a Co-operative

Budgeting is one of the most important things a co-operative business can do. A co-op’s budget allows boards and staff to create a plan for the coming years that can be presented to the members and openly discussed. Though not all co-ops do this, preparing budgets allows members some input on the co-operative’s operations, provides potential funders with a quick glimpse into the co-op’s financial intentions, and allows leaders to develop a financial strategy that can help the co-op evaluate its position. This guide will offer some insight on budgeting in a co-operative.

Be Inclusive

Budgeting is typically done by the board with a treasurer or staff leading most of the planning. However, forming finance and audit committees could allow members to participate in and learn about the process. This allows makes way for new perspectives and encourages more involvement. A co-operative’s budget will impact its members, therefore it makes sense to include them in the preparation process.

Give back to members and community

One of the defining characteristics of co-operatives is their attachment to their members and the communities they serve. Co-ops do this by giving financial benefits back through dividends to members and donations to the community. This doesn’t need to be an massive commitment. Sponsoring local sports teams, organizing barbeques, and arranging holiday festivities are great ways to build community support for the co-op without a lot of spending. Also, giving dividends to members can give them a bigger sense of ownership in the co-operative.

When not to give back

While giving back to members is a good way to keep them engaged in the co-op, it’s important to keep in mind the co-operative’s need to access funds and make investments. Keeping a portion of its surplus allows the co-op to hold on to some profits to make investments and have extra cash on hand. Retained earnings can be returned to the members later or when the shares are redeemed. This can be an unpopular decision as members may expect a return. Including members in the budget-making process is a great way to better understand these concerns and present information.

Invest in the co-operative’s future

It is important to also use a budget to plan for a co-op’s future. This is done by putting money in a reserve fund for times when business takes a downturn. Another important, sustainable financial strategy is to invest in the co-op by upgrading equipment, training staff, and expanding operations. Where possible, find ways to enhance the co-operative’s assets (e.g. through solid investments) and minimize its liabilities (e.g. pay down debt). These will help ensure that the co-operative is in good financial standing and well-positioned for the future.

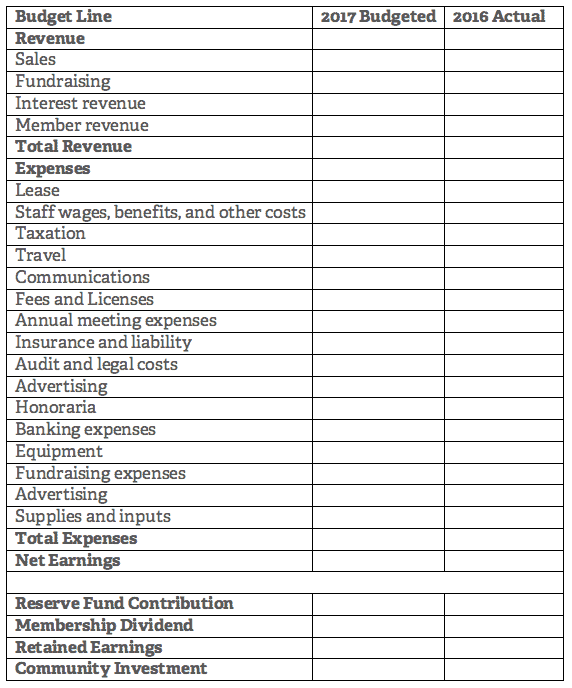

Sample Budget Lines

The following table provides suggestions for budget lines. Accountants or bookkeepers should adapt a budget to a co-op’s financial situation.

Enjoy this tool on budgeting a co-operative? You may be interested in our next set of tools for when your co-operative is up and running, or our article on the documents your co-op needs to get going.

Was this useful?

15 people found this useful.