How to allocate your co-op’s profits

Disclaimer: This document intends to provide the reader with a basic understanding of the role of surplus in a co-operative business and should not replace advice from an accountant or lawyer or the decisions made by shareholders.

As your co-operative’s fiscal year ends, the board needs to decide what it will do with the co-operative’s profits. Co-ops handle profits differently than other businesses and usually return a large portion of their profits to the communities they serve. Plus, what you do with the profits will impact members, the taxes the co-op pays, and its long-term planning.

The calculate your co-op’s profits, subtract all its expenses from its total revenue:

Revenue – expenses = profit/surplus

There are a few different ways co-operatives can allocate their profits, and the methods you choose will depend on your specific circumstances, growth plans, risk threshold, and members’ preferences. In this resource, we’ll unpack the options available to your co-op and how to manage the funds you’ll allocate.

Non-profit Co-ops

Non-profit co-ops (sometimes called community service co-ops) have limited options. While they can still generate a profit from their operations, they can’t share that profit with members or investors. As a non-profit co-op, you have three options:

- Allocate funds to your reserve fund.

- Donate funds to a charitable organization.

- Leave the funds in an operating account for investment in future activities (like expansion, investing in new equipment, hire extra staff or a contractor, purchase inventory, or simply have a cash buffer).

A non-profit co-op won’t get taxed on its net income, so there’s no need to allocate all your surplus funds; they can remain in your operating account. On your co-operative’s balance sheet, any funds in your reserve fund and an operating account will be listed as cash assets and reflected as equity in the liabilities section.

For-profit Co-ops

For-profit co-ops can share their profits with members or investors, so you have some additional options and things to consider:

Patronage allocation

A patronage allocation (also called a patronage dividend or return) is a share of the co-op’s profits allocated to its members. This money is issued in proportion to how much each member used the co-op that year (e.g. how many hours a member worked in a worker co-op, or how much product a member sold to the co-op in a producer co-op). A patronage allocation can be paid in cash or equity (called allocated capital or member equity). Choose to allocate equity if the co-op wants to hang onto more cash for projects. The co-op will eventually have to pay out member equity/allocated capital to the member when they cease to be a member – but for now, you’ll have more cash on hand.

Retained earnings or unallocated equity

Your co-op may want to hang on to some funds that aren’t allocated to the members and don’t have to be repaid to invest in new projects or expand the business. Most co-operatives will do this in two ways:

- By using net income generated from business done with non-members

- By using retained earnings from net income on business done with members.

Investment Dividends

If your co-operative has issued investment shares, your investors are probably expecting a return on their investment. Some co-operatives will issue dividends with a promised annual rate of return (e.g., 7% ROI per year), while in other co-ops, the board decides how to allocate dividends from the annual profits.

Donations

Although you don’t have to wait until year-end to make donations, many co-operatives will donate a portion of their profits to charities and community activities.

For more on how to calculate and issue dividends, check out this resource.

Allocating Funds

Once your fiscal year ends, your board needs to decide how it will allocate profits. This includes deciding how much money the co-op will hang on to, and how much cash it can give out.

Let’s use an example to tease this out. For now, we won’t worry about taxation. That’s something we’ll tackle later once the board decides where it wants to direct funds.

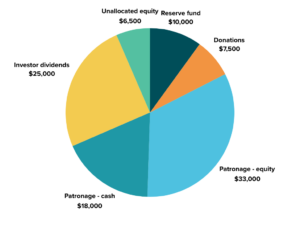

Let’s imagine a co-op with profits of $100,000:

- Off the top, it wants to tuck some money into a reserve fund. The co-op chooses 10% or $10,000.

- The co-op is approached by a local charity looking for sponsorship, so it decides to allocate $7,500 as a donation.

- The co-op has an obligation to its investors and allocates a quarter ($25,000) to be distributed as dividends on investment shares.

- The co-op wants to reward its members for supporting the co-op, so it allocates a little more than half of its profits to the members ($51,000). However, it needs to hang on to some of that cash to invest in a new processing facility, so instead of distributing all of this in case, it allocates $33,000 in equity and $18,000 in cash. In both cases, the amount each member receives is based on how much they’ve “used” the co-op. The allocated equity is held by the co-op in the member’s name to be paid out later.

- It also decides not to allocate too much equity to the members, just to ensure it has some capital reserve in case older members apply to withdraw their equity. The co-op sets aside $6,500 as retained earnings or unallocated capital.

Allocating profit is kind of like carving up a pie and giving a piece to your various stakeholders. Your board needs to decide who gets a large slice or who doesn’t get a piece at all.

Taxation

For-profit co-ops will pay small business or corporate tax on net income (profits), so they will often try to reduce their taxable income.

Donations and patronage allocations are paid before taxes, so they reduce the co-op’s taxable income. But money is set aside for reserve fund contributions, unallocated equity, or for distribution to investors after tax – so consider this when making decisions about allocating funds.

If we apply this to our example, a 9% small business tax rate would mean the co-op has $38,073 left for investors, unallocated equity, and its reserve fund.

What your co-op’s board needs to consider

As you can see from our example, your co-op’s board needs to consider a lot of factors when allocating profits. It needs to balance obligations to shareholders, needs of the community, member preferences, and taxes. But there are a few more considerations to be aware of that may impact your co-op over the short and long term.

Reserve fund obligations: Most co-operatives are required to place a set amount of their profits in a reserve fund. Be sure to check this requirement (either in your bylaws or in the Coop Act) before allocating funds.

Personal income tax: As we mentioned, allocating patronage can reduce the co-op’s taxable income. But keep in mind that your members might be taxed for that income once it’s in their hands.

For instance, when a worker co-op issues patronage allocations, the cash portion is viewed as a bonus, paid based on the number of hours that member worked. In that case, it is taxed like wages. Be mindful of the impact your allocations have on individual members.

Allocated equity and the horizon problem: By allocating equity, a co-op designates that equity in the member’s name and hangs onto the cash. The co-op will need to pay that money to the member at some point in the future, either when the member withdraws from the co-op (often upon retirement) or if the co-op has a program that regularly pays down equity. Your board needs to be aware of the impact allocated equity might have on the co-op. Suppose several older members retire and apply to withdraw their equity all at once. Such a large call on the co-op’s capital might leave it low on cash and unable to make new investments. For this reason, co-ops should develop an equity policy to manage the amount of allocated equity set aside each year and the outflow of cash to members.

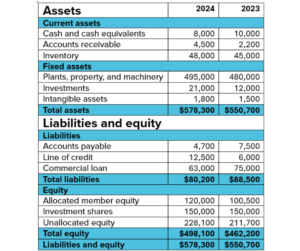

Impact on the balance sheet: Each year, the decisions your board makes about allocating profits will have an impact on the co-op’s balance sheet. Retained earnings, allocated capital, and reserves will bolster the equity portion of your balance sheet which may make the co-op attractive to investors or lenders. Equity is the portion of the co-op’s wealth that the co-op and its members own outright; it’s the value they’ve built over the years that they don’t owe to a lender. As a result of the different options available to co-ops, their balance sheet may look different than those produced by other organizations.

Look at this sample balance sheet to see some of the terms we’ve used. Consider what decisions the board of this co-op might have made to cause the changes between 2023 and 2024.

We can tell that the board allocated some profit to allocated member equity and unallocated equity. We can also assume that dividends were paid to investment shareholders. We can see there was no change in the investment capital, so investors seem to be okay with leaving their money in place.

In this case, we can also see that the co-op reduced its liabilities (the money it owes) and increased its total equity (equity is what the co-op owns outright). A lender or investor assessing the health of this business will probably be interested in the co-op’s debt-to-equity ratio, which in this case is a very low 0.16. This indicates the co-op is a very safe investment. Such a high level of equity is usually an indication the co-op is more mature or has a very wealthy community of supporters.

Important note in this case: most of the co-op’s assets are tied up in its property, so if many investors or members apply to redeem their shares, they may not have enough cash to cover that many redemptions. In this case, the board should be aware of how many members are approaching retirement and that may apply to redeem their equity. Encouraging member recruitment or developing a policy to manage member equity can mitigate this risk.

In that case, remember the following formula:

Total allocation to a member – proportion for allocated member equity = cash paid to member

A member’s patronage dividends cheque should be for the amount of cash paid to the member. Along with the cheque, you should also provide each member with a statement of their equity in the co-op.

Was this useful?15 people found this useful.